Structural deficiencies cloud the outlook of French construction industry

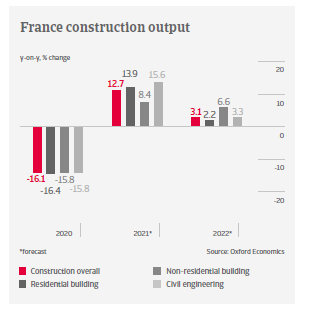

After contracting 14% in 2020, French construction output is forecast to rebound by about 13% in 2021, and to grow 3% in 2022. Residential building and civil engineering are driving the recovery. The renovation work segment remains resilient, while the Next Generation EU fund will provide large investments in projects with a sustainability aspect. However, commercial construction activity remains hampered by subdued investment in retail and office buildings.

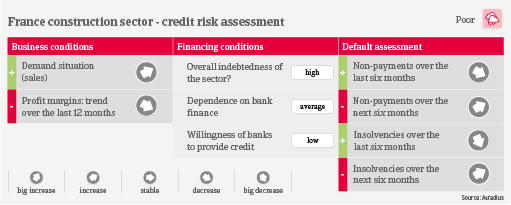

Over the past couple of years, French construction has faced structural problems, such as cash issues for businesses due to difficulties in funding their working capital requirements. Profit margins are expected to decrease further in the coming months, due to sharply increased construction material prices and rising labour costs. Many contracts do not contain escalation clauses, and the credit risk situation of companies with tight margins is about to deteriorate, which are mainly affected by material shortages, volatile input pricing and postponement of projects. It does not help that banks are generally reluctant to support the short-term financing needs of construction businesses.

Payments in the construction industry take 64 days on average, compared to 44 days on average for all other industries. Public bodies and larger construction companies in particular tend to extend payment terms. Payment behaviour has been rather bad over the past two years. Thanks to government support measures, construction insolvencies remained low in 2020 and in H1 of 2021, but an increase of up to 10% is expected in the coming months.

While the current sector performance could be assessed as “Fair” due to robust demand and ongoing stimulus measures, structural sector fundamentals (tight margins, working capital issues, default frequency) remain “Poor”. Pandemic-related downside risks remain, and despite the strong growth forecast, French construction will not reach its pre-pandemic levels until early 2023.

Documents associés

1.06MB PDF