Rise in payment delays sparks switch to strategic credit risk management

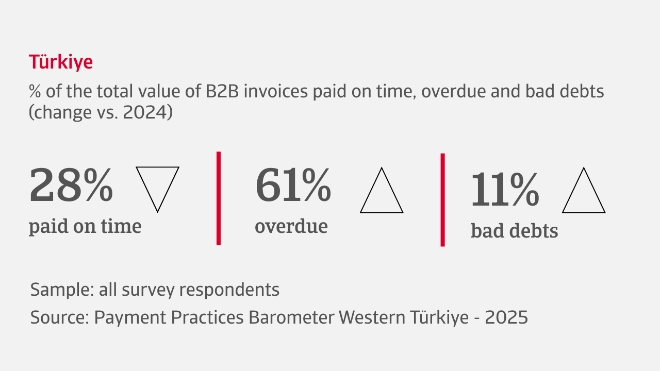

A growing number of companies in Türkiye, particularly in the chemicals sector, report that customer payment behaviour has deteriorated rather than improved in recent months. This concerning trend is highlighted by late payments now affecting an average 61% of all B2B invoices, an increase on the previous year. Bad debts have doubled, now impacting approximately 10% of B2B invoices. This sharp rise reflects growing financial pressure, especially in the steel and metals industry, which has been hit hardest by customer payment issues.

73% of businesses across industries in Türkiye have increased their trade credit offerings in a strategic effort to protect market share in a highly competitive environment and support business customers facing liquidity constraints. The trend is particularly notable in the steel and metals industry, where competitive pressures are high. To offset heightened exposure to customer payment risks due to these increased credit offerings, most suppliers have kept payment policies steady, typically capped at 30 days from invoicing.

Our survey finds that surface-level stability in Days Sales Outstanding (DSO) hides an underlying financial stress and elevated payment risk arising from B2B trade on credit. Compounding the existing pressures on working capital, half of suppliers in Türkiye report inventory build-up. Many businesses experiencing this have opted to delay payments to their suppliers as a strategy to preserve liquidity, while for the remainder Days Payable Outstanding (DPO) has remained unchanged. To further bridge liquidity gaps, nearly 80% of Turkish companies are requesting supplier credit.

Looking ahead

Widespread concern over rising insolvency risk and deteriorating DSO

Nearly one third of companies across industries in Türkiye are bracing for a rise in B2B customer insolvencies during the coming months. The rest of the businesses are divided, with some expecting insolvency levels to remain at the current levels, while others are uncertain about what lies ahead. This discrepancy highlights a significant sense of unease about the financial future. Within the chemicals sector, in particular, there is worry as companies grapple with unpredictable shifts in insolvency trends, adding even more complexity to their financial outlook.

This widespread mood of uncertainty found in our survey is compounded by expectations of a negative trend in Days Sales Outstanding (DSO), with companies facing longer wait times for cash inflows. As a result, working capital is likely to be increasingly tied up in receivables and unable to be quickly freed up for operational needs. Companies are also concerned that this limited opportunity to generate cash from receivables may not be offset by inventory turnover. With unpredictable sales performance, many businesses anticipate stagnant or even growing stock levels, further exacerbating liquidity pressures.

All these challenges are compounded by muted expectations around profitability, creating a tough environment where cash flow remains strained and operational flexibility is limited. To manage these issues, companies are turning to strategies like slowing down payments to suppliers to preserve liquidity. However, in the face of increased payment risks, more businesses are also relying on supplier credit and outsourced risk management services, along with internal provisioning, as a means of safeguarding their financial stability.

In the current uncertain economic landscape, adaptability and strategic customer payment risk management are becoming essential to safeguard liquidity and ensure operational stability.

Industry insights

Agri-food

Half of the B2B sales in the agri-food sector are currently being transacted on credit, while 71% of firms report increased trade credit offerings to support sales and maintain customer relationships. To offset the consequent greater exposure to customer payment risks most have kept payment terms steady, typically capping them at 30 days from invoicing. Overdue payments are a growing concern, affecting 59% of B2B invoices, with bad debts now standing at 10% of B2B sales. To mitigate the impact of these late payments and defaults, 60% of companies increased efforts to collect payments and reduce DSO fluctuations.

Chemicals

51% of B2B sales are being made on credit in the chemicals sector, reflecting a more lenient approach to trade credit extension. Payment terms are steady, typically ranging between 31 and 60 days from invoicing, although some firms opted to extend longer terms. Overdue payments continue to strain cash flow, affecting nearly two-thirds of B2B invoices. Bad debts levels increased to now impact an average 10% of B2B sales. To address these challenges, three in five firms increased efforts to collect payments and manage DSO fluctuations. Unchanged inventory levels have increased pressure on liquidity as cash remains tied up in unsold goods.

Steel and metals

84% of companies increased trade credit offerings in recent months and nearly half of B2B sales are made on credit. Despite this more relaxed approach the majority of firms kept payment terms consistent, typically limiting them to 30 days from invoicing. Overdue payments are a significant worry, now affecting 65% of B2B invoices. Bad debts account for 10% of invoices on average, highlighting increased payment risks. Many companies have responded by ramping up efforts to collect payments and manage DSO more effectively. While there is no significant change in inventory levels, many firms are facing liquidity pressures as unsold stock and outstanding receivables tie up large amounts of cash.

Interested in finding out more?

For a complete overview of the 2025 survey results for Türkiye, download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- 73% of businesses in Türkiye have increased trade credit offerings to business customers to protect market share and remain competitive

- Surface-level stability in payment collection timings and Days Sales Outstanding (DSO) hides underlying payment risk across supply chains

- Nearly one third of companies in Türkiye expect a rise in B2B customer insolvencies

- Businesses are concerned about the unpredictable economic outlook, rising production costs, tightening regulations, and the need for sustainability practices